Allianz online revolutionizes the way users engage with insurance services, offering a comprehensive suite of tools that enhance accessibility and user satisfaction. By embracing digital innovation, Allianz online not only streamlines traditional processes but also provides a user-friendly platform that responds to modern needs.

From navigating the expansive range of services to leveraging customer support, Allianz online stands out by prioritizing user experience, security, and the empowerment of its clients through easy access to essential resources.

Overview of Allianz Online Services

Benefits of Allianz Online Compared to Traditional Services

Utilizing Allianz Online provides numerous advantages over traditional insurance services. The primary benefits include:- Accessibility: Customers can access their accounts and services 24/7, eliminating the need to visit a physical office.

- Efficiency: Processes such as obtaining quotes, managing policies, and filing claims are streamlined, significantly reducing wait times.

- Cost-Effectiveness: Online services often come with lower premiums and fewer hidden fees compared to traditional methods.

- Transparency: Users have easy access to their policy details, claims history, and coverage options, promoting informed decision-making.

- User-Friendly Interface: The portal is designed for ease of use, making it accessible for individuals with varying levels of tech savviness.

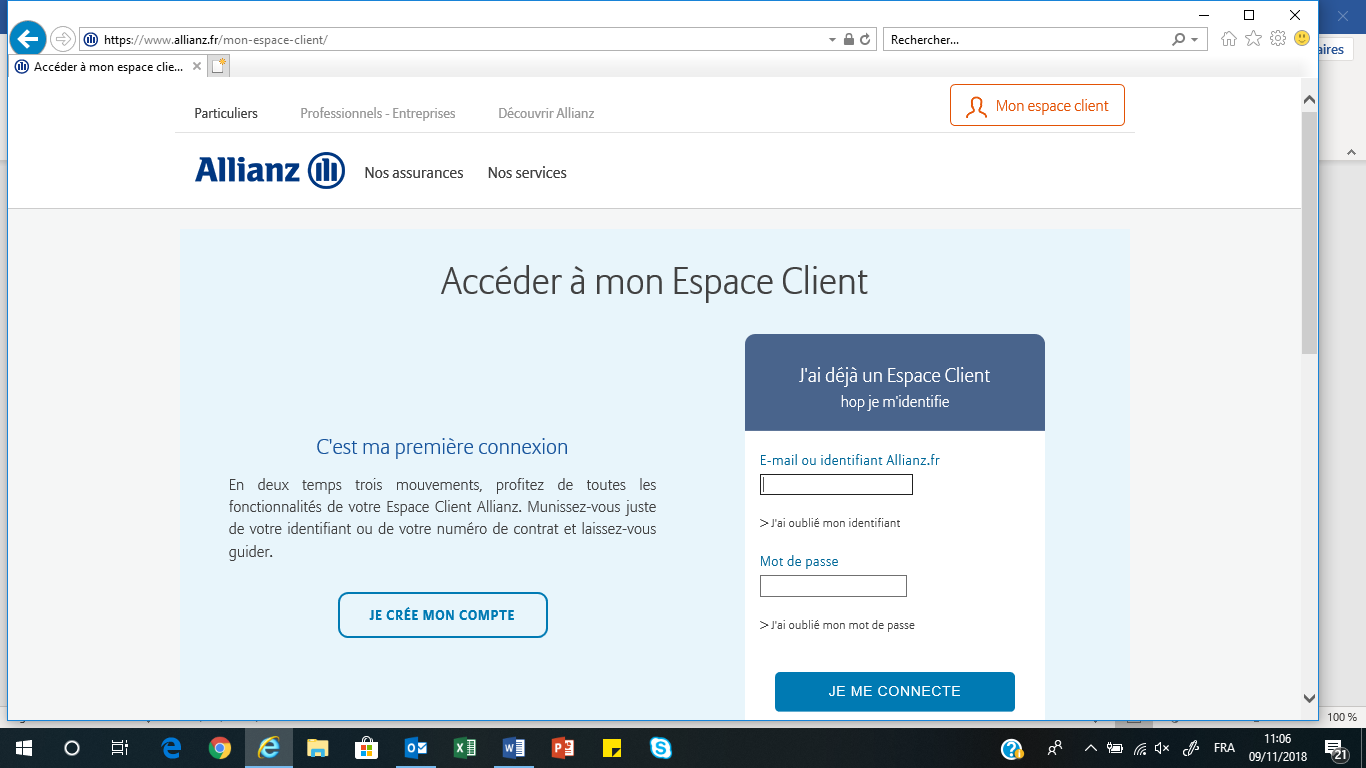

Navigating the Allianz Online Portal Effectively

Navigating the Allianz Online portal effectively can significantly enhance the user experience. The portal is designed with intuitive features that guide users seamlessly through their insurance needs. Here are some key components to focus on:- Dashboard: Upon logging in, users are greeted with a personalized dashboard that summarizes their policies, claims, and any required actions.

- Policy Management: The policy management section allows users to view, edit, and manage their coverage options easily.

- Claims Submission: Users can submit claims directly through the portal by following a straightforward step-by-step process, including uploading necessary documents.

- Resource Center: The portal features a resource center filled with articles and FAQs that help users understand various aspects of their insurance policies.

- Mobile Accessibility: Allianz Online is fully optimized for mobile devices, ensuring that users can manage their insurance on the go.

"Allianz Online not only simplifies insurance management but also empowers users with the tools they need to make informed decisions about their financial future."

User Experience and Accessibility: Allianz Online

User Interface Design

Allianz Online features a clean and modern user interface that prioritizes simplicity and functionality. The layout is organized, making it easy for users to find relevant information quickly. Key design elements include:- Responsive Design: The platform is optimized for various devices, ensuring a consistent experience whether accessed via desktop, tablet, or smartphone.

- Intuitive Navigation: Clear menus and well-structured categories facilitate effortless browsing, allowing users to locate services and information without unnecessary clicks.

- Visual Hierarchy: Important information is prominently displayed, enhancing user engagement and ensuring critical functionalities are easily accessible.

Accessibility Features

Allianz Online incorporates several accessibility features to cater to users with disabilities. These enhancements are crucial for fostering an inclusive digital environment. Key features include:- Screen Reader Compatibility: The platform is designed to work seamlessly with screen readers, allowing visually impaired users to navigate and access content effectively.

- Keyboard Navigation: Users can interact with the site using keyboard shortcuts, which is essential for individuals who cannot use a mouse.

- Color Contrast Adjustments: High contrast options are available to improve readability for users with visual impairments.

User Feedback and Suggestions for Improvement

User feedback plays a vital role in the continuous enhancement of Allianz Online. Common themes from user experiences include:- Performance Issues: Some users have reported slow loading times, particularly during peak usage periods, suggesting a need for improved server capacity.

- Mobile App Enhancements: While the website is well-received, several users have expressed a desire for more robust features in the mobile app, such as easier claims submission processes.

- Comprehensive FAQs: Users have requested a more detailed FAQ section to address common inquiries, enhancing self-service capabilities.

Improving user experience and accessibility not only enhances customer satisfaction but also fosters loyalty and trust in the Allianz brand.

Security and Privacy Measures

In the digital age, maintaining the security and privacy of user data is paramount, especially for online services such as Allianz Online. The platform implements advanced security protocols designed to protect sensitive information, ensuring that users can engage with confidence. This section explores the comprehensive measures that Allianz Online has put in place to safeguard user data, alongside best practices users can adopt to bolster their security.Security Protocols Implemented by Allianz Online

Allianz Online employs a multifaceted approach to security, integrating various layers of protection to defend user data against potential threats. Key components of their security framework include:- Data Encryption: All data transmitted between users and the Allianz Online platform is encrypted using industry-standard protocols such as TLS (Transport Layer Security), protecting information from eavesdropping during transmission.

- Two-Factor Authentication (2FA): To enhance user account security, Allianz Online offers 2FA, requiring users to verify their identity through a secondary method, such as a mobile app or SMS code, in addition to their password.

- Regular Security Audits: Allianz conducts periodic security audits and vulnerability assessments to identify and mitigate potential risks, ensuring that their security measures are up-to-date and effective.

- Access Controls: User access to sensitive information is strictly controlled based on defined roles and permissions, minimizing the risk of unauthorized access.

Best Practices for Users to Enhance Security

While Allianz Online implements robust security measures, users also play a crucial role in protecting their data. Adopting certain best practices can significantly enhance security when using the platform:- Create Strong Passwords: Users are encouraged to create complex passwords that include a mix of letters, numbers, and special characters, and to avoid using easily guessable information.

- Regularly Update Passwords: Changing passwords periodically can mitigate the risks associated with potential data breaches.

- Avoid Public Wi-Fi: Users should refrain from accessing their Allianz Online accounts over public networks, as these connections can be vulnerable to interception.

- Monitor Account Activity: Regularly reviewing account statements and transactions can help users detect any unauthorized activity early.

Comparison with Industry Standards

Allianz Online's security measures align with, and in many cases exceed, prevailing industry standards. The platform's commitment to safeguarding user data reflects a proactive approach that is essential in today's cybersecurity landscape. The following points illustrate how Allianz Online's practices stack up against typical industry standards:- Encryption Standards: Allianz Online utilizes AES-256 encryption, which is regarded as a gold standard in data protection, similar to practices observed in major financial institutions.

- Compliance with Regulations: Allianz adheres to regulations such as GDPR and CCPA, ensuring user data handling meets or exceeds legal requirements, a policy that is often a hallmark of leading companies in the industry.

- Incident Response Protocols: The platform has well-defined incident response plans that ensure rapid action and transparency in the event of a data breach, a strategy that aligns with best practices recommended by cybersecurity authorities.

Customer Support and Resources

Allianz Online prioritizes customer service, offering a variety of support options to ensure users receive the assistance they need efficiently. With multiple channels available, customers can easily access help whether seeking quick answers or in-depth guidance on various services. This comprehensive support structure is designed to enhance user satisfaction and streamline the experience on the platform.To facilitate prompt assistance, Allianz Online provides several customer service channels, each with its own response time. Below is a table summarizing the expected response times for various support options:| Customer Service Channel | Response Time |

|---|---|

| Email Support | 24 hours |

| Live Chat | Immediate |

| Phone Support | Within 5 minutes |

| FAQs and Help Center | Available 24/7 |

Available Resources and Guides for New Users, Allianz online

Allianz Online offers a range of resources aimed at assisting new users in becoming acquainted with the platform. These resources include detailed guides and tutorials that cover essential functionalities and services. New users can benefit from the following resources:- Getting Started Guide: A comprehensive introduction to setting up an account, understanding features, and navigating the user interface.

- Video Tutorials: Step-by-step videos demonstrating how to utilize various services, from policy management to claims submission.

- Knowledge Base: A searchable database containing articles on frequently asked questions, troubleshooting tips, and service explanations.

- Webinars: Live sessions where users can learn directly from Allianz experts and ask questions in real-time.

"Empowering users with knowledge and resources is key to a seamless experience on Allianz Online."

FAQ Explained

What types of insurance can I manage through Allianz online?

You can manage various types of insurance, including health, auto, home, and travel insurance through Allianz online.

Is there a mobile app for Allianz online?

Yes, Allianz online offers a mobile app for easier access to services and management of your policies on the go.

How can I reset my password for Allianz online?

To reset your password, click on the "Forgot Password" link on the login page and follow the instructions sent to your registered email.

Are there any fees for using Allianz online services?

No, there are no additional fees for accessing Allianz online services; all standard services are included in your policy.

Can I contact customer support directly through Allianz online?

Yes, you can contact customer support through the live chat feature or by accessing the support section within the Allianz online portal.

When considering financial security, understanding insurance is crucial. It protects you from unforeseen circumstances and helps manage risks effectively. However, not every insurance provider offers the same level of service or coverage options. To make an informed decision, researching the best insurance companies can guide you toward the most reliable options tailored to your needs.

When it comes to securing your future, understanding the nuances of insurance is essential. It serves as a safety net, providing financial support during unforeseen events. However, not all insurance policies are created equal, which is why it's beneficial to explore the best insurance companies that offer comprehensive coverage tailored to your needs.

Choosing the right coverage can significantly impact your financial well-being, making it crucial to evaluate the best insurance companies available in the market. These companies stand out for their reliability and customer service, ensuring that you’re well protected. By understanding the various types of insurance options, you can make informed decisions that align with your lifestyle and budget.