Car insurance plays a crucial role in safeguarding drivers and their vehicles, offering a safety net in times of unexpected incidents. The world of car insurance can be complex, with various types of policies available, each designed to meet different needs and circumstances. Understanding the distinctions between comprehensive, third-party, and collision insurance is essential for making informed decisions, ensuring that you select the right coverage tailored to your specific situation.

As we explore this topic, we will delve into the factors influencing insurance premiums, the intricacies of the claims process, and practical tips for reducing costs. Each aspect of car insurance is designed to equip you with the knowledge necessary to navigate the road to financial security while driving.

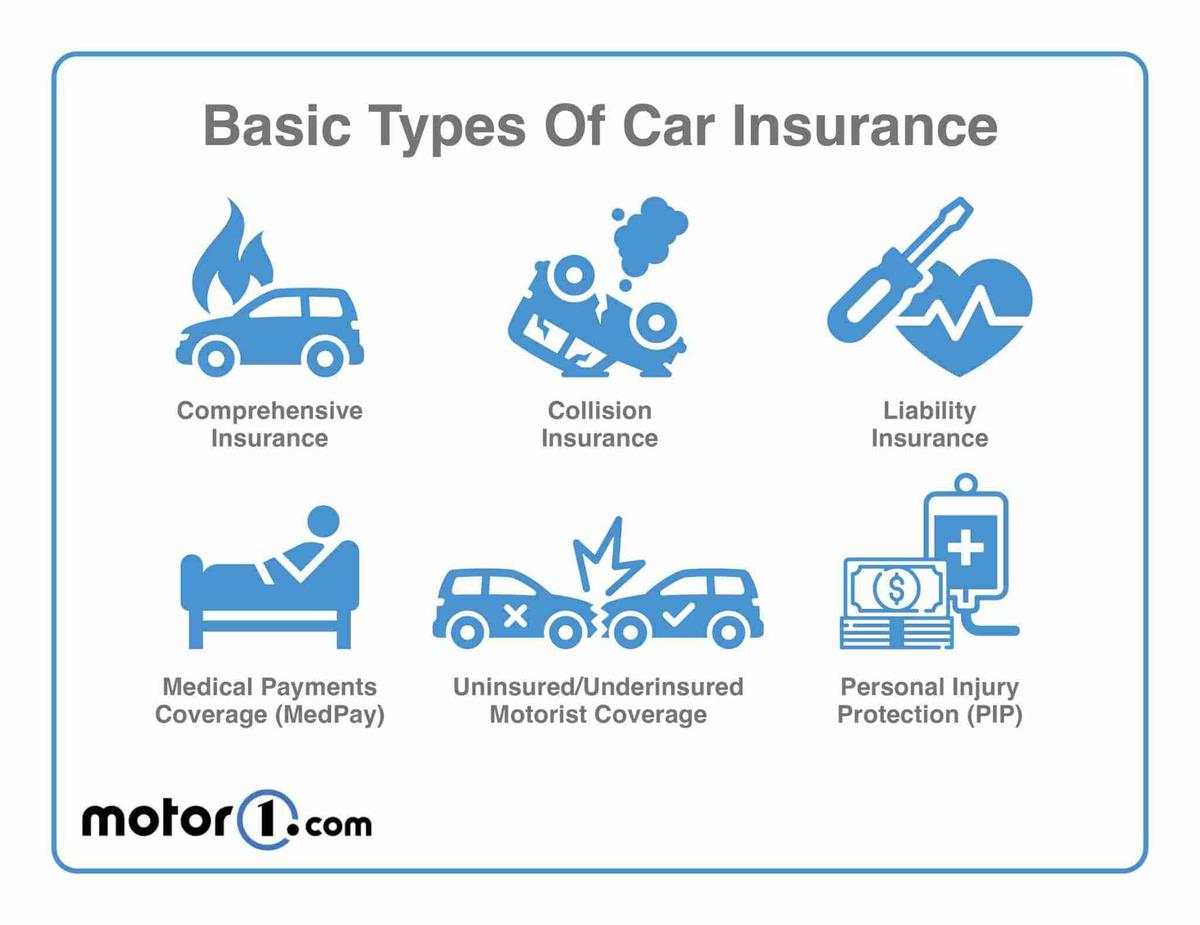

Types of Car Insurance

Comprehensive Insurance

Comprehensive insurance provides the most extensive coverage, protecting against a wide range of risks. This type of policy covers damages to your vehicle not only from accidents but also from theft, vandalism, natural disasters, and other incidents.- Advantages:

- Offers broad protection against various types of damages.

- Covers theft and other non-collision incidents.

- Can protect against uninsured motorists.

- Disadvantages:

- Typically more expensive than other types of coverage.

- Might have higher deductibles compared to basic policies.

Third-Party Insurance

Third-party insurance is the most basic type of car insurance, legally required in many regions. It covers the costs of damages to another person’s vehicle or property if you are found at fault in an accident.- Advantages:

- Generally the least expensive insurance option.

- Meets legal requirements in most areas.

- Easy to understand with straightforward coverage.

- Disadvantages:

- Does not cover damages to your own vehicle.

- Limited protection may leave you financially vulnerable in severe accidents.

Collision Insurance

Collision insurance covers damages to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. This type of coverage is particularly beneficial for those with newer or more valuable vehicles.- Advantages:

- Provides financial protection for your vehicle in case of an accident.

- Can be crucial for those with expensive cars or leases.

- Disadvantages:

- Does not cover non-collision incidents such as theft or natural disasters.

- Can add to overall insurance costs if paired with other policies.

"Choosing the right car insurance is about balancing coverage and cost to fit your lifestyle and financial situation."Making the right choice between comprehensive, third-party, and collision insurance depends on individual needs and circumstances. Evaluate your driving habits, vehicle value, and financial capabilities to select the most suitable coverage for your situation.

Factors Affecting Car Insurance Premiums

Car insurance premiums are influenced by a variety of factors that insurance companies consider when calculating rates. Understanding these factors can help drivers make informed choices and potentially reduce their insurance costs. This section will delve into the key elements that impact car insurance premiums, providing insights into how driving history, age, vehicle type, and location contribute to the overall cost.Driving History and Claims Profile

A driver's history plays a significant role in determining their insurance premium. Insurance providers assess the driver's past behavior on the road to gauge risk levels. Key elements include:- Accidents: Drivers with a history of accidents may face higher premiums due to the perceived higher risk of future claims.

- Traffic Violations: Speeding tickets, DUIs, and other violations can lead to increased rates as they indicate irresponsible driving behavior.

- Claims History: Frequent claims, regardless of fault, can raise premiums. Insurers view multiple claims as a sign of riskier behavior.

Insurance companies often categorize drivers based on their claims profiles, leading to differentiated premiums.

Age and Experience Level

Age is another critical factor in determining car insurance premiums. Younger drivers typically face higher rates as they lack driving experience and are statistically more likely to be involved in accidents. Conversely, older, more experienced drivers generally benefit from lower rates. The following points highlight how age affects insurance costs:- Teen Drivers: Drivers aged 16-19 represent the highest risk group, resulting in significantly higher premiums.

- Young Adults: Rates may decrease as drivers reach their mid-twenties and gain more driving experience.

- Senior Drivers: Although experienced, rates may rise again for drivers over 65 due to increased likelihood of health-related incidents impacting driving skills.

Age-related statistics show that drivers aged 25 to 65 often enjoy the lowest premiums due to their proven driving records.

Vehicle Type and Safety Ratings

The type of vehicle being insured can greatly influence premium rates. Insurers evaluate various aspects of the vehicle, including:- Make and Model: Sports cars and luxury vehicles tend to have higher premiums due to their higher repair costs and increased theft rates.

- Safety Features: Vehicles equipped with advanced safety technology, such as anti-lock brakes and airbags, may qualify for discounts, as they reduce the likelihood of accidents.

- Vehicle Age: Older vehicles might have lower premiums, but they also may lack modern safety standards, potentially leading to higher liability costs in case of an accident.

The safety ratings of vehicles can directly impact insurance premiums, with higher-rated vehicles typically offering lower costs.

Location and Regional Risk Factors

The geographical location where a driver resides significantly affects car insurance costs. Insurers consider various regional factors that can influence the likelihood of claims, including:- Population Density: Urban areas with higher traffic congestion and accident rates generally lead to higher premiums compared to rural areas.

- Crime Rates: Regions with a high incidence of vehicle theft or vandalism can result in increased insurance costs.

- Local Weather Patterns: Areas prone to severe weather conditions, such as hail, snowstorms, or flooding, can see higher premiums due to the increased risk of damage.

Insurance companies use data from various sources, including local crime statistics and traffic reports, to assess the risk associated with specific locations.

Claims Process in Car Insurance

." />Steps Involved in Filing a Car Insurance Claim

The claims process begins immediately after an accident occurs. Here are the essential steps to follow:1. Ensure Safety: Check for injuries and move to a safe location if possible. 2. Collect Information: Gather details from the accident scene, including contact information of all parties involved, witness names, and insurance information. 3. Document the Scene: Take photographs of the vehicles, damages, and the accident scene. This visual evidence can be critical for your claim. 4. Notify Your Insurance Company: Contact your insurer as soon as possible to report the accident. Many insurers have a dedicated claims hotline for this purpose. 5. File the Claim: Complete the necessary forms as guided by your insurer. Ensure all information is accurate and comprehensive. 6. Follow Up: Stay in contact with your insurance adjuster to monitor the status of your claim and provide any additional information if requested.Common Mistakes to Avoid During the Claims Process

Navigating the claims process requires careful attention to detail. Avoiding common mistakes can prevent delays and complications. Here are some pitfalls to watch out for:- Failing to Report the Accident Promptly: Delays in notifying your insurer can lead to claim denial. - Inaccurate Information: Providing incorrect details or omitting critical information can result in complications with your claim. - Not Documenting the Scene: Failing to gather evidence at the accident scene can weaken your claim. - Accepting Fault Too Soon: Avoid admitting fault at the scene before all facts are established, as this can impact your claim's outcome. - Neglecting to Follow Up: Not actively following up on your claim can lead to misunderstandings and delays in processing.Checklist for Necessary Documents and Information

Having the right documents and information on hand is crucial when filing a claim. Below is a checklist to ensure you are fully prepared:- Accident Report: A police report if one was filed. This provides an official account of the accident. - Photos of the Accident Scene: Visual documentation of damages and the scene. - Insurance Information: Your policy number and details of your coverage. - Contact Information: Names, addresses, and phone numbers of all parties involved in the accident. - Witness Statements: Contact details of any witnesses who can corroborate your account of the incident. - Medical Reports: Documentation of any medical treatment received as a result of the accident. - Repair Estimates: Quotes for car repairs from licensed auto repair shops.By following these guidelines, you can navigate the claims process more effectively and ensure you are prepared with all necessary documentation.Tips for Reducing Car Insurance Costs

Strategies for Lowering Car Insurance Premiums

Employing a mix of practical strategies can significantly reduce car insurance expenses. These strategies include maintaining a good driving record, opting for higher deductibles, and ensuring that your vehicle is equipped with safety features. The following are key methods to consider:- Maintain a clean driving record: Avoid accidents and traffic violations to qualify for lower premiums.

- Increase your deductible: Higher deductibles can lead to lower monthly payments, but ensure you can afford the deductible in case of a claim.

- Choose your vehicle wisely: Cars that are safer, have lower theft rates, and are cheaper to repair often come with lower insurance premiums.

Benefits of Bundling Policies, Car insurance

Bundling different types of insurance policies can yield significant financial benefits. Many insurance companies offer discounts to customers who purchase multiple policies, such as car and home insurance, from them. This not only simplifies managing your insurance but can also lead to substantial savings. Consider the following advantages of bundling:- Cost savings: Bundling can save you up to 25% on your total premiums.

- Simplified management: Having one provider for multiple policies makes payments and claims easier to manage.

- Loyalty benefits: Insurance companies may offer additional incentives for bundled services, enhancing your overall coverage experience.

Importance of Maintaining a Good Credit Score

Insurance companies often use credit scores as a factor to determine premiums. A higher credit score generally translates to lower insurance costs. Maintaining a good credit score can lead to significant savings, making it essential to monitor and improve your credit standing regularly. Consider the following points related to credit scores and insurance:- Regularly check your credit report: Look for any errors that could negatively affect your score.

- Pay bills on time: Timely payments contribute positively to your credit score.

- Limit new credit inquiries: Avoiding excessive credit applications helps maintain a stable score.

Discounts Typically Offered by Insurance Companies

Many insurance companies provide discounts that can help policyholders save on their premiums. Understanding these discounts and the eligibility criteria can lead to significant savings. Below are common discounts available:- Good driver discount: Awarded to those with a clean driving record.

- Multi-car discount: Available when insuring more than one vehicle on the same policy.

- Safety features discount: For vehicles equipped with safety features like anti-lock brakes and airbags.

- Low mileage discount: For drivers who use their vehicles infrequently or have low annual mileage.

- Student discount: Offered to young drivers who maintain good grades in school.

Expert Answers

What is comprehensive car insurance?

Comprehensive car insurance covers damages to your vehicle not involving a collision, including theft, vandalism, and natural disasters.

How can I lower my car insurance premium?

You can lower your premium by maintaining a good driving record, bundling policies, and taking advantage of available discounts.

What factors affect my car insurance rates?

Key factors include your driving history, age, type of vehicle, and where you live, as these elements can significantly influence your premiums.

How do I file a car insurance claim?

To file a claim, gather necessary documents, contact your insurance provider, and complete their claims process as Artikeld in your policy.

What discounts are typically available for car insurance?

Common discounts include good driver discounts, multi-policy discounts, and discounts for safety features installed in your vehicle.